The second important feature of most term life insurance policies is that it is convertible to a permanent, level premium policy without providing any medical evidence of insurability.

This is a great feature because as we age our health changes. The big three health issues are cancer, stroke and heart attack but there are lots of other health issues that develop as we age.

Once you own a term life insurance policy you have locked in your protection and your insurability. If you develop a health problem and are facing a big increase in your term life insurance you can convert some, or all of the protection to a level premium permanent policy.

Many people find that as they near the end of their 10 or 20 year term that the risky years are mostly behind them and that the children are grown and their debts smaller that the need for life insurance protection is less but they still want protection.

These people convert some of their term insurance to a permanent policy to build estate values that provides much needed cash at time of death for tax planning needs or to leave a legacy for children and grandchildren.

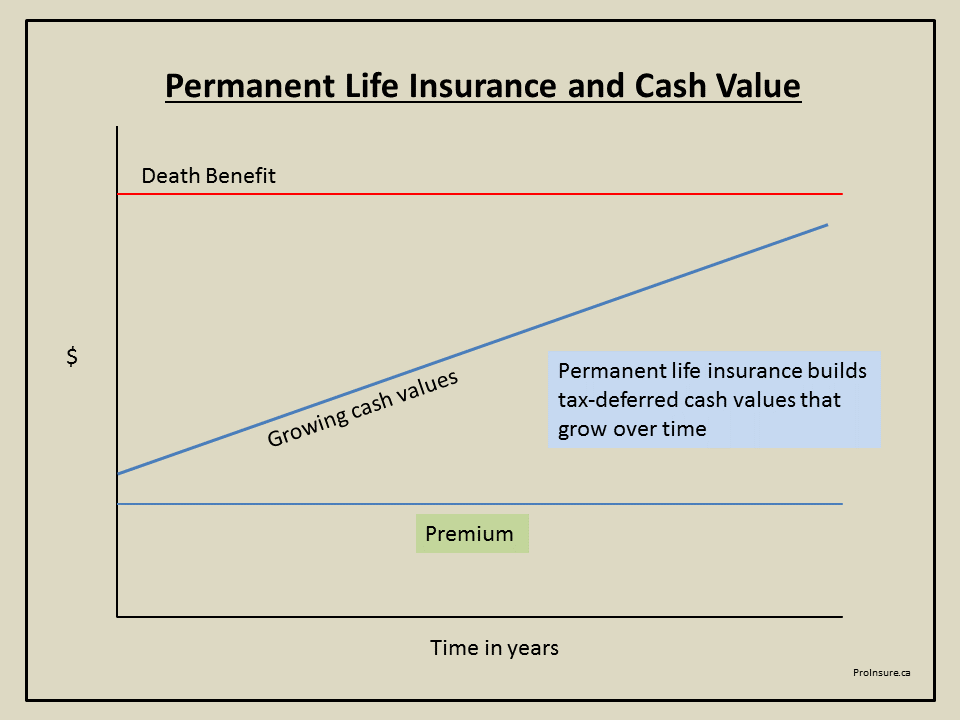

Most permanent plans build a cash value, this value grows on a tax-deferred basis and can be taken out later in life and used as income to supplement retirement income or pay long-term care costs. If the tax-sheltered funds are not needed for supplementing one’s income the money plus any growth, will pass, tax-free to named beneficiaries.

Converting term insurance is best done earlier than later. The cost of insurance is less when one is younger and the tax-free compounding of the cash value works best over long periods of time; the longer the better.

In our next blog we will review how much insurance a person should own.