Blog Posts

Parents want to protect their children. For the parents of children with a disabilities, this is especially important, as their child may not have the financial means or the capacity for financial...

Senior Executive Comprehensive Health Strategy A senior executive comprehensive health strategy, often referred to as an executive health program or executive wellness program, is a specialized...

Lower after-tax cost There are several tax advantages of owning life insurance inside a corporation. The first is the lower-after tax cost of premiums. To pay a $1000 premium a high income earner...

Employee engagement and benefit plan survey Are you thinking about adding and employee benefits plan to your employees’ compensation plan? You might want to ask them whether they want or need a...

What key areas can create big problems? How can you shield your business from hidden risks? Is your plan administrator part of the problem? Late Enrolment Most employee benefit plans require all new...

By Julie Holden, Principal – Holden and Associates Consulting Inc. Most employers understand the need to accommodate an employee when they’re ill, but what does this mean and when does it start?...

Many people wonder, what is biodiversity? It simply means you have many different types of plants and critters in your garden. Many gardens are not biodiverse and are dominated by lawns of non-native...

Taxation Issues Employer paid group life, CI, AD&D and dep. life premiums are taxable benefits for employees. Long Term Disability benefits are not taxed when received, if the premium is 100% paid...

Are you a small incorporated business owner who is paying for your health and dental expenses out of pocket? There is a better way...

Make Sure to Finish your Milk Will In our personal and professional lives, we deal with deadlines all the time. Many of the things we do on a regular basis have firm due dates — meeting a...

Did you know that the cost of mental health problems and illnesses to the Canadian economy is reported to be at least $51 billion a year? In an average week, mental health issues caused 500,000...

If you are an incorporated business owner or professional you should open a healthcare spending account even you have a group benefit plan. A healthcare spending account can pay for all the items a...

Life insurance and Congenital Heart Disease Since I co-founded the Canadian Congenital Heart Alliance 10 years ago, one of the complaints I hear regularly from congenital heart patients is that they...

What is a “hybrid” group benefit plan? Many organizations are looking at a new group benefit plan design that not only is better at engaging their employees but also saves money, money...

Do you need a business speaker for your next event? We have developed an entertaining and informative presentation entitled, “Preparing your business for sale.” We deliver a presentation...

Many business owners are unaware that one minor change to their employee benefit plan can result in happier, less stressed, more productive and engaged employees. Here’s what financial...

I feel like Rick Mercer when I hop up on my soap box and tell clients what a lousy product mortgage insurance is, I get quite animated and I wish Rick would do a public service televised rant because...

Planning one’s estate is important because it helps minimize taxation and makes certain that your assets got to you family and friends, or charitable organisation in accordance with you wishes thereby...

I get many questions about probate fees at the estate planning seminars that I run at Toronto seniors’ residences. As an insurance broker and estate planning advisor I am quick to point out that I...

Most traditional life insurance companies treat SCUBA diving as a risky sport. Scuba diving is lumped in with other “hazardous sports and hobbies” such as hang gliding, skydiving, motor racing and...

Many older Canadians have much of their wealth tied up in their homes, and some have poor cash-flow. I recently met a woman at one my estate planning seminars in Toronto who told me that she...

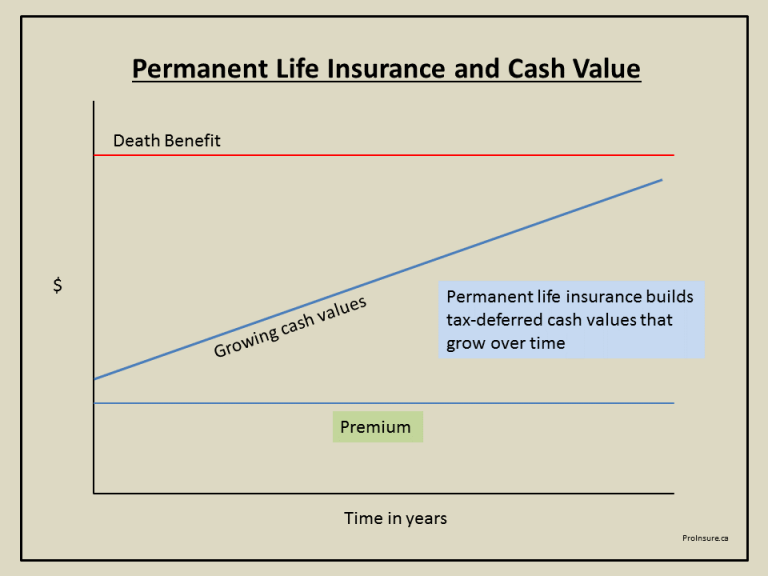

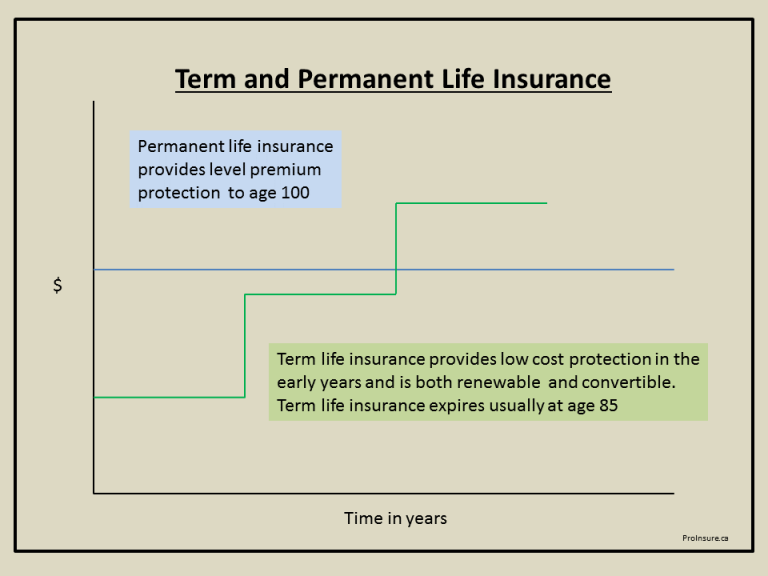

The second important feature of most term life insurance policies is that it is convertible to a permanent, level premium policy without providing any medical evidence of insurability. This is a great...

I wanted to remind you of two important features of term life insurance. Term life insurance policies are typically both renewable and convertible and these nifty features are built in to most term...

ProInsure has developed a multi-disciplinary, client centric approach to helping business owners build value and develop business efficiencies as they plan for the day they will change ownership of...

Are you ready to sell your business and is your business ready to be sold? I am going to stick my neck out here and say no – to both questions. You are not ready to sell your business and as a result...

Many of us purchase large amounts of low cost term insurance to cover our needs while we are raising our families or growing our businesses. However, as the saying goes, “there is no free lunch”. ...

Do you have a succession plan for your business? If you are like over 87% of most business owners are too busy running your business to find the time to write a succession plan. Having a plan in...

Buyers are more comfortable when the sellers have insured themselves properly. It shows the buyer that they are serious about selling the business. There are many unforeseen events that can put...

Buy/sell agreements provide for the transfer of the ownership of the business in different circumstances death, disability, retirement or disagreement. At death or disability, for example, the...

The Super Visa is a 10 year visa which allows parents and grandparents stay for up to two years at a time. “The launch of Canada Super Visa is aimed to bring considerable reductions in the long...